Hudson Formula

The so-called “Hudson Formula” is a topic of considerable debate within the legal and engineering communities. However, it is crucial to recognize that this formula lacks a solid foundation in both law and logic. Generally, it is widely accepted that damages and off-site overheads cannot be accurately determined through a rigid formula. While the Hudson Formula is briefly mentioned in Hudson’s Building and Engineering Contracts, it has gained attention in various texts and occasionally appears in legal judgments. Therefore, it becomes essential to comprehend the inherent flaws within the Hudson Formula.

The Hudson Formula, named after its originator, attempts to provide a systematic approach for quantifying damages and off-site overheads in construction and engineering contracts. Its proponents argue that it offers a straightforward and consistent method to calculate these costs, thereby simplifying the often complex and subjective process of assessing damages. However, upon closer examination, numerous flaws emerge that cast doubt on the formula’s validity and applicability in legal and practical contexts.

One of the primary criticisms against the Hudson Formula lies in its lack of grounding in legal principles. Legal disputes, particularly in construction and engineering contracts, require a comprehensive examination of the specific circumstances, contractual provisions, and applicable laws. In contrast, the formula tends to overlook these crucial factors, reducing the assessment of damages and off-site overheads to a mere mathematical calculation. This oversimplification disregards the nuanced complexities that often arise in such cases, potentially leading to unfair outcomes and inadequate compensation for parties involved.

Moreover, the formula’s reliance on standardized metrics and fixed percentages raises significant concerns about its suitability in capturing the unique aspects of each construction project. Construction projects can vary widely in terms of scope, complexity, geographical location, and other contextual factors, rendering a one-size-fits-all approach inadequate. By attempting to fit diverse projects into a rigid formula, the Hudson Formula fails to account for the specific intricacies that may significantly impact the determination of damages and off-site overheads.

Furthermore, the Hudson Formula’s inability to adapt to evolving industry practices and changing economic conditions further weakens its credibility. Construction and engineering sectors constantly experience technological advancements, regulatory changes, and market fluctuations that influence project costs and overheads. These dynamic factors require a flexible and nuanced approach to assessing damages, which the formula inherently lacks.

Additionally, the formula’s limited consideration of qualitative aspects further undermines its effectiveness. Construction disputes often involve intangible factors such as project delays, loss of reputation, and client relationships, which cannot be accurately quantified through a rigid mathematical formula. By focusing solely on financial aspects, the Hudson Formula fails to capture the full scope of damages suffered by the aggrieved party, leading to an incomplete and potentially unfair assessment.

In conclusion, despite the occasional references to the Hudson Formula in texts and legal judgments, it is important to recognize its inherent flaws. The formula’s lack of legal grounding, oversimplification of complex disputes, inflexibility, and failure to consider qualitative factors significantly diminish its value in accurately determining damages and off-site overheads. As construction and engineering contracts continue to evolve, it becomes increasingly crucial for legal practitioners, industry professionals, and stakeholders to be aware of these flaws and seek alternative approaches that provide a more comprehensive and equitable assessment of damages.

There are several different formulas masquerading as the Hudson Formula. They fall into two categories which, for convenience will be called :

1- The Extra cost formula, and

2- The lost chance formula.

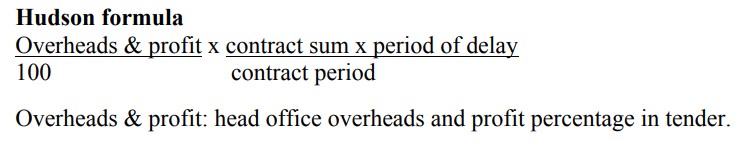

The Hudson formula has been extensively cited, and used, especially in the United Kingdom and other common law jurisdictions. The Hudson formula is constructed in a very simplified manner to calculate overheads and profits as follows:

There are problems with this formula, however, as it is relying on a number of assumptions. The main problem is that the calculation is derived from a number which already contains an element of head office overheads and profits, causing double counting, which cannot be avoided.

Another problem is that the formula does not provide any assistance to the determination of the percentage rate for profit and overheads recovery for a particular case. In general, there is a preference for the other two formulas, which are considered as slightly more precise even though, due to its simplicity, the Hudson formula is still frequently used in practice.

Why is the Hudson Formula used?

The formula is used by contractors in an attempt to avoid the necessity for proof of loss. As can be seen from the various books and papers that promote the use of the Hudson Formula, contractor might be excused if they believe that the formula can be used to prove claims.

Astonishingly enough, the Hudson Formula has baffled many a contractor, and for good reason too! Its application is ostensibly geared towards circumventing the onerous burden of furnishing proof of loss. Books and papers galore extol the virtues of this enigmatic formula, leading contractors to harbour the belief that its use can serve as a panacea for all their claim woes. It’s simply mind-boggling how one formula could be the answer to all their troubles. But who knows, perhaps the Hudson Formula has some mystical powers that remain to be uncovered.

Example:

The Hudson Formula is a common method used in the construction industry to calculate overhead and profit for a construction contract. This formula takes into account the estimated and actual costs of the project, as well as the profit margin and overhead expenses of the contractor.

The formula for calculating overhead and profit using the Hudson Formula is as follows:

Overhead and Profit = (Estimated Costs + Estimated Overhead) x (Profit Margin / 100)

Where:

- Estimated Costs: the projected cost of completing the project

- Estimated Overhead: the projected overhead expenses for the project

- Profit Margin: the desired profit margin for the contractor

The result of this calculation is the overhead and profit that the contractor will earn from the project. If the result is positive, the contractor will have earned a profit that includes overhead expenses. If the result is negative, the contractor will have incurred a loss that includes overhead expenses.

Here’s an example:

A construction company estimates that a project will cost $1,000,000 to complete, with $100,000 in overhead expenses. The contractor also desires a profit margin of 10%.

Using the Hudson Formula, we can calculate the overhead and profit for the project as follows:

Overhead and Profit = ($1,000,000 + $100,000) x (10 / 100) = $1,100,000 x 0.1 = $110,000

In this case, the result is positive, indicating that the contractor will earn a profit of $110,000 that includes overhead expenses.

It is important to note that the Hudson Formula is just one method for calculating overhead and profit in a construction contract. Other formulas or methods may be used depending on the specifics of the project or contract.

Conclusion

Contractors would be better advised to ignore formulas when trying to prove damages for delay. In attempting to use a formula the claimant is likely to become embroiled in an argument on the applicability of the formula. It is an interesting legal argument and is likely to make the law reports. However, the argument is unlikely to succeed, it is likely to prove expensive to run and it will divert attention from the real issue which is to prove the contractor’s actual loss. A contractor should explore the question of whether the delay has in fact caused any loss of income and if so how that loss can be demonstrated.

If the contractor is separately paid the direct costs incurred during the period of delay and they are less than the income which could have been earnt but for the delay, the balance represents the loss of profit and contribution to overheads. There is no need to demonstrate the usual margin for profit or for overheads or that the contractor would have earnt a profit.

Relevant issues include:

1. The probability of the contractor earning extra income but for the delay;

2. The amount of income which but for the delay the contractor might have earnt;

3. The savings [ amounts which the contractor would have had to expend to earn that income, the expenditure of which has been saved];

4. Whether the loss of income would reasonably have been within the contemplation of the parties at the time of contracting .

This is not an exhaustive list. There may be issues of mitigation. The contractor may have to answer arguments that the contractor could have mitigated the loss of income by hiring plant [to replace that tied up on the delayed contract] or engaging subcontractors or more staff or paying overtime. It is most unlikely that a contractor could, in the face of an argument from the other party, persuade a court that a formula is a valid substitute for proof of any matter. If an alleged loss cannot be proved otherwise than by recourse to a formula, then it is time to question whether the loss in fact occurred.